Introduction:

Filing your taxes doesn’t have to be daunting! In this post, we’ll share some valuable tips to make the tax filing process easy and stress-free while avoiding common costly mistakes. Whether you’re filing your taxes for the first time or a seasoned taxpayer, following these tips will help ensure accuracy and compliance, saving you time and money in the long run.

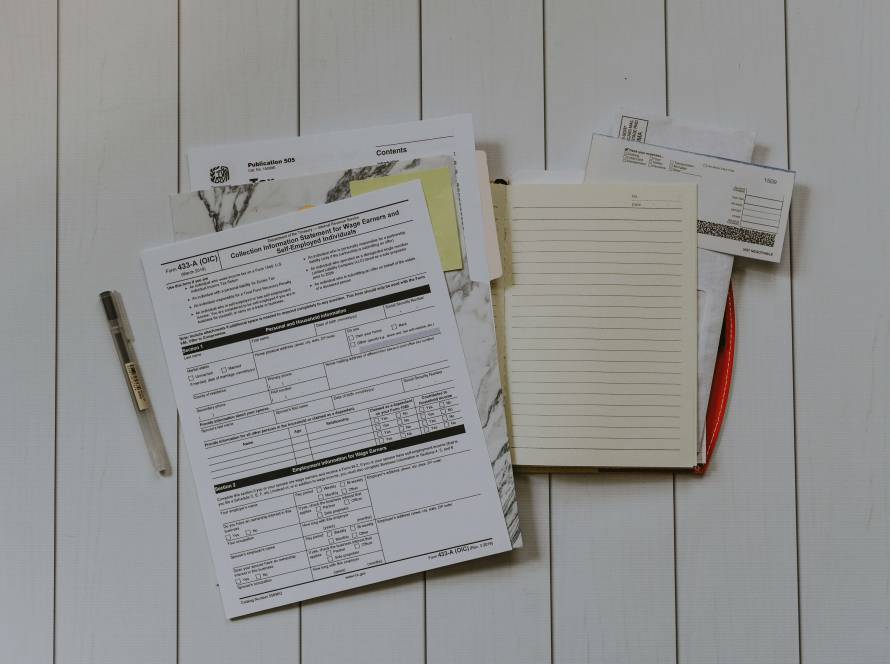

1. Organize Your Documents:

Start by gathering all necessary documents, including W-2s, 1099s, receipts, and other financial records. Organize them systematically to ensure you have everything you need to complete your tax return accurately. Missing or incomplete documentation can lead to errors and potential audits.

2. Double-Check Your Information:

Take your time to review all information entered on your tax return carefully. Ensure accuracy in reporting income, deductions, and credits. Even a small error, such as a typo or misplaced decimal point, can result in miscalculations and costly consequences.

3. Don’t Miss Deadlines:

Mark important tax deadlines on your calendar and make sure to file your tax return and pay any taxes owed on time. Failing to meet deadlines can result in penalties, interest, and additional fees, increasing your overall tax bill.

4. Seek Professional Assistance if Needed:

If you’re unsure about certain tax rules or have a complex tax situation, don’t hesitate to seek assistance from a qualified tax professional. An accountant or tax advisor can provide expert guidance, helping you navigate the tax laws and maximize your tax benefits while minimizing potential risks.

5. Keep Records for Future Reference:

Retain copies of your filed tax returns and supporting documents for at least three to seven years, depending on your specific situation. These records serve as valuable documentation in case of audits, inquiries, or future tax-related issues.

Conclusion:

By following these simple tips, you can streamline the tax filing process and avoid costly mistakes in the 2024 tax year. Remember to stay organized, double-check your information, meet deadlines, seek professional assistance when needed, and keep thorough records for future reference. With careful planning and attention to detail, tax filing can be a smooth and hassle-free experience. Happy filing!